Origins of an Investing Podcast

Published on Medium on October 14, 2018

Did you find the podcast, or did the podcast find you?

On a wintry day in February 2016, I sat on a chair lift at Haystack Mountain in Vermont with my friend Gregg Clark. Gregg is a warm-hearted guy who I’m quite sure could be a world-champion on Jeopardy. He is an encyclopedia of both useful and useless knowledge, equally facile in the arcane details of financial modeling as in the wisdom of the Toltec Indians. An engineer by training, one weekend Gregg saw that the full-sized electronic bowling alley in the kid’s center of the ski lodge had stopped working. He heard the manufacturer couldn’t fix it until Monday, so he took the manual overnight and fixed it himself the next morning.

As we rode our way up the mountain, Gregg asked if I listened to podcasts. At the time, I had no idea what a podcast was and didn’t know the purple app on my iPhone existed. He directed me to The Tim Ferriss Show, and I was hooked.

Around the same time, my first book So You Want to Start a Hedge Fund: Lessons for Managers and Allocators released. After a dozen years focused on sourcing, researching, and investing in early stage hedge funds, I had acquired a body of knowledge that most aspiring entrepreneurs in the industry could not access. I noticed I was having the same conversation repeatedly and decided to put pen to paper so more people could learn from the past lessons of others.

The book also marked the end of a chapter in my professional life. I was keen to leave a narrowly siloed world of allocating capital to hedge funds and get back to broader mandate akin to where I started my career.

In this window of transition, I received several invitations to share the lessons of the book publicly. I appeared on business television, radio, and lo and behold, a series of podcasts. One podcast conversation stood out. In October 2016, I sat down to speak to Patrick O’Shaughnessy in what became the seventh episode of his phenomenal podcast, Invest Like the Best. I was blown away by this young kid’s preparation and ability to ask just the right questions. We became fast friends, and he asked me to join another conversation with Brent Beshore that proved as enjoyable as the first.

The experience with Patrick also demystified what happens behind the magic curtain of podcasting. We met in his office and had a conversation in front of two microphones. It seemed as simple as that.

A short time afterwards, I saw a Facebook post that my college friend Chris Douvos was the guest on a podcast. Chris is the highly entertaining ‘Super LP’ of venture capital and Managing Director at Venture Investment Associates. I listened and was appalled. The questioning was so rote and scripted, and the energy so low, that the hosts managed to make Chris sound dull. If you listen to my podcast conversation with Chris (Episode 14), you’ll understand that it’s quite a feat to crush his energy.

That day, a light bulb went off in my head. I had time on my hands and wanted to reconnect with some of my old friends who I never had time to see in the day-to-day grind of work and family. I doubted I could match Patrick’s breadth of knowledge, but I figured I could do a little better than the folks who interviewed Chris. I decided to create a podcast interviewing people who are tasked with managing large pools of capital. I called Patrick to inquire about how it all works. He sent me on a mission to purchase a laundry list of equipment, record a few conversations, and connect with producer Mathew Passy, The Podcast Consultant, to assist with the startup and production.

And off I went.

I recorded a fantastic conversation with my friend Steve Galbraith, who had written a wonderful foreword for my book. I knew Steve well enough to guide the conversation through his remarkable career and filter in fun stories about his owning a local brewery and a European football team. I couldn’t believe how good the conversation went and was excited to share it.

There was only one problem — I lost the recording. For the next 6 hours I couldn’t find the recording on my Zoom H6 Handy Recorder. I was just baffled. I reached out to Mathew and the customer service representatives at Zoom, and I searched the internet for a solution. All of it was to no avail.

I was about to declare the end of my nascent podcast career, when I thought of calling the one person who might have an answer when no one else did — Gregg Clark. Sure enough, Gregg hooked up the device to his computer, plugged in a few extra wires, hit play, and an hour and eleven minutes later had downloaded a perfect digital recording of the episode out of thin air.

Before launching the podcast, I recorded two more conversations. One was with my beloved former business school professor, Andre Perold. The other occurred live at a HBS Student Investment Conference with my former colleague and star endowment manager, Paula Volent from Bowdoin College.

But a week later Paula called and asked that I not air the conversation. My plan to launch with three episodes got cut by one-third just like that. I nevertheless released the episodes with Steve and Andre and sent an email to friends in my contacts about the endeavor. Two hundred of them listened to one of the initial episodes. From there, I reached out to a few friends and asked them to join me for an interview.

That’s the rote story of how the podcast came together, but there’s another side to the story that is harder to explain. Michael Mervosh described a different way of moving through life during our podcast conversation. He posed the question, “Did I find the podcast, or did the podcast find me?”

The podcast was one of the first times in my life that I took on a professional challenge without a goal in mind. I had time on my hands and thought it would be a fun and productive way to spend some of that time while searching for my next full-time engagement. I imagined the conversations would help me re-engage in the investment world more broadly than a sole focus on hedge funds, even if that was more an external perception than my internal reality since hedge funds encompass investments across assets, geographies, and strategies. I figured the adventure would create some optionality, and I had no idea what those options might bring.

The only thing I knew for sure was that I didn’t like the sound of my own voice and was fairly sure others wouldn’t either. I didn’t know if I would interview well or if I would be able to keep a conversation going. I wondered if I would run out of guests to interview, of subjects to discuss, or of time to keep it going. And I never once thought of the adventure as a business — even a cursory level of analysis revealed that offering content for free to a finite natural audience is not the road to riches. I really didn’t care about that, because I was ready to try something new without feeling tied to an outcome.

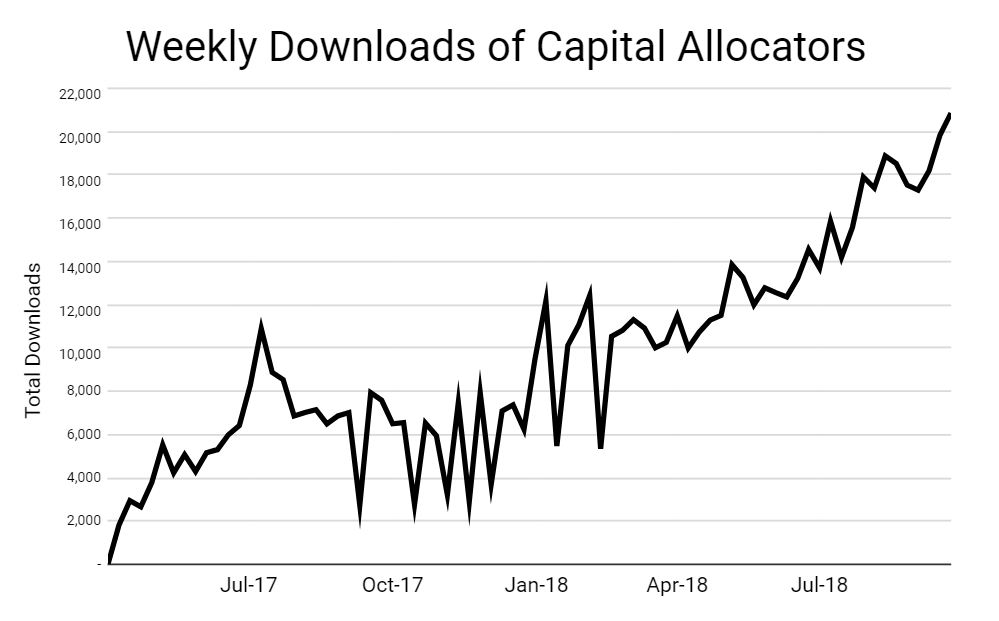

As a result, I can’t explain what happened in the ensuing year and a half. I sent out one email, and through word-of-mouth and digital word-of-mouth (posting the episodes on LinkedIn and Twitter), the 200 downloads that first week grew 100x in a trajectory that looks like the hottest market fad of the day — the bitcoin of 2017 or cannabis of 2018. It’s a chart a technical analyst would love.

I started receiving positive feedback from old friends and new. Some commented on my excellent “voice for radio,” rebuffing the only definitive prior I held. Others reflected an interview style of humility and curiosity that I would describe as a mirror of my best self. Most importantly, the podcast guests universally appreciated the experience, commenting on the platitudes and unexpected benefits they received after coming on the show.

As I released episodes one week after the next, I started to realize I had come upon an educational platform unlike anything else available. I had the privilege of working with many top-flight investors in my two decades of experience, and 38 of the first 40 podcast guests were friends and acquaintances from that period. I hadn’t appreciated how little these people and their insights were in the public eye. One of my favorite examples came from Jim Williams, the long-time Chief Investment Officer of the Getty Trust. Following our recorded conversation, Jim mentioned how much he had learned from my podcast with his peer, Scott Malpass of Notre Dame. I was surprised, knowing that the two had been friends for decades. Jim explained that although they speak a few times a year, he never had the chance to hear Scott’s story in its entirety. At that moment, I realized that I hadn’t either, nor did just about any of the show’s listeners.

My guiding light in building the roster of guests has been answering the simple question of who I would like to speak to now, and what I would like to learn. I love hearing someone’s personal story — investing is indeed a people business — so all the episodes start that way. Many guests have fit into my original concept of diving into the people, philosophy, and process for the holders of the keys to the kingdom. We’ve also explored other disciplines and decision-making practices that might help Chief Investment Officers improve their skill set. In what can only be described as a personal passion, I’ve taken great joy in combining my love of statistics, investing, and sports and interviewing some of the leading thinkers in the cross-section of that field.

A year and a half into this adventure, the podcast has gone beyond my expectations and has been great fun. I’ve had wonderful conversations with brilliant minds and met some incredible people along the way. I still don’t view it as a business, and I don’t know where it or I will head, but it has proven a fruitful exercise in growth without goals.